The Fed met January 30th through 31st and decided to keep its benchmark rate at a range of 5.25% to 5.50%, which it’s held since July 2023. The Fed board members left the meeting with a hopeful tone, but the meeting results are somewhat disappointing to those pushing for rate cuts in March. The door for cuts is cracked open, but we now expect rate cuts to begin closer to summer rather than in spring. Fed chairman Powell’s rationale is reasonable: the current rate levels seem to be working, and if it’s not broken, don’t fix it. The Fed’s dual mandate is for stable prices (inflation ~2%) and low unemployment. Currently, inflation is dropping, and unemployment is low, at 3.7%. Recession fears have declined once again, and the soft landing — slowing the economy without recession — that the Fed intended seems to be unfolding. Powell was quick to say the Fed does not have a growth mandate, which is correct, so the risks of cutting rates early will likely outweigh the benefits of cutting in March. However, if inflation continues to fall, and economic indicators are still favorable, rate cuts will likely start mid-year.

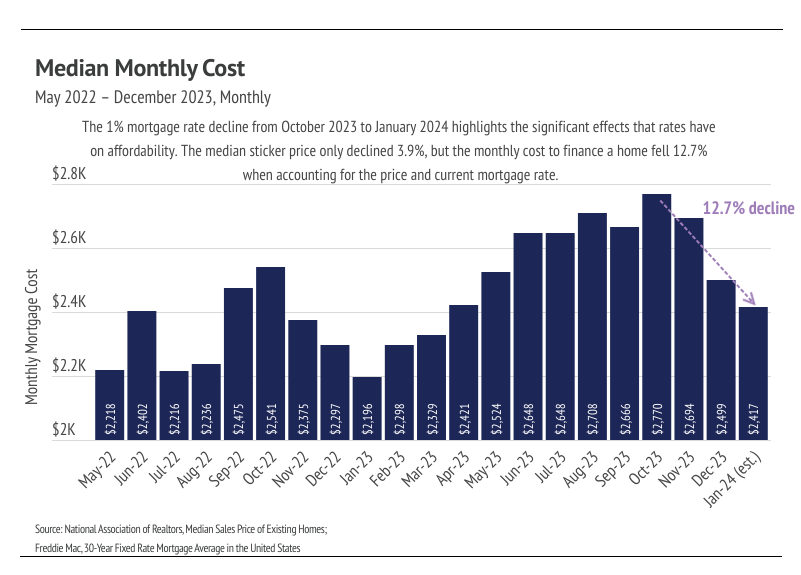

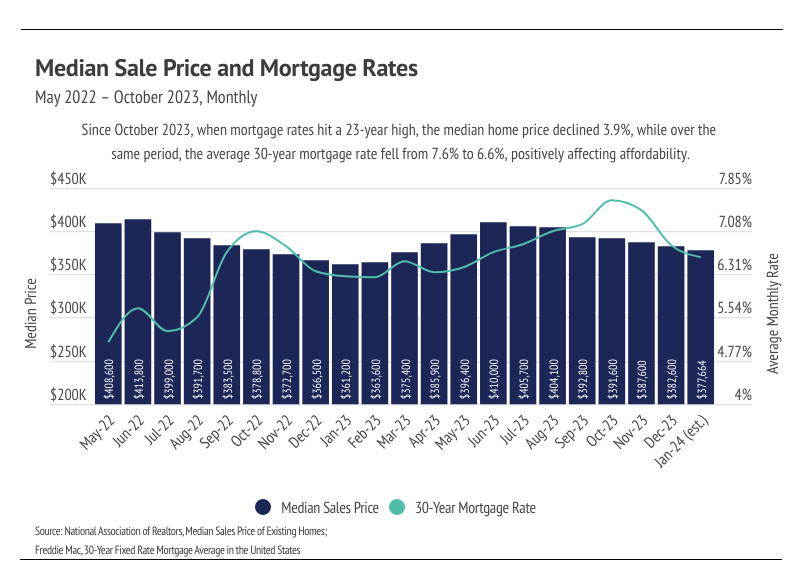

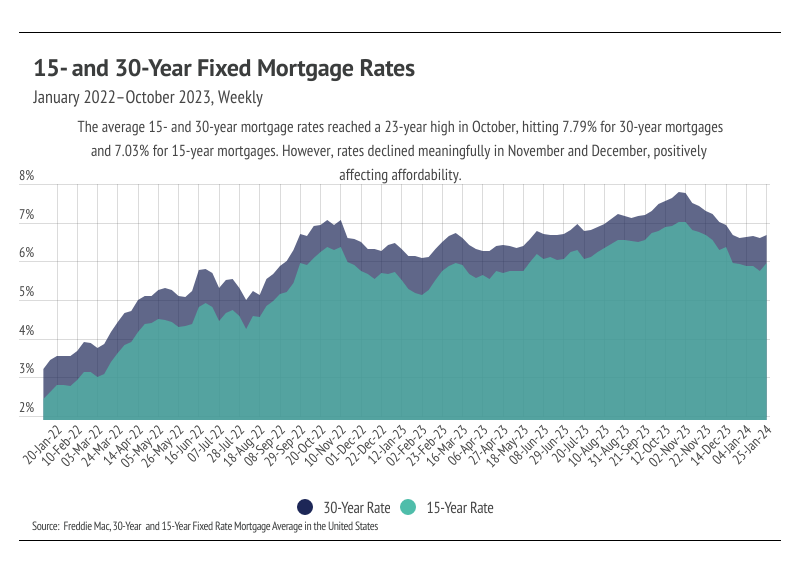

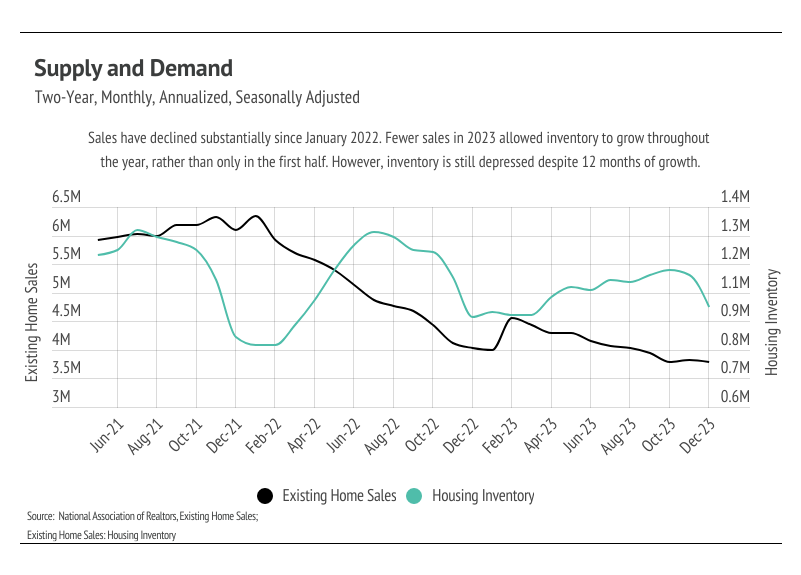

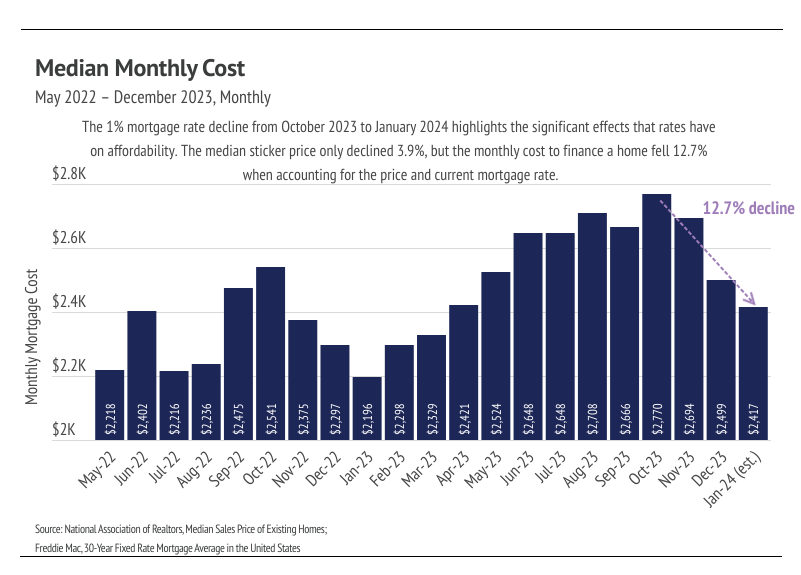

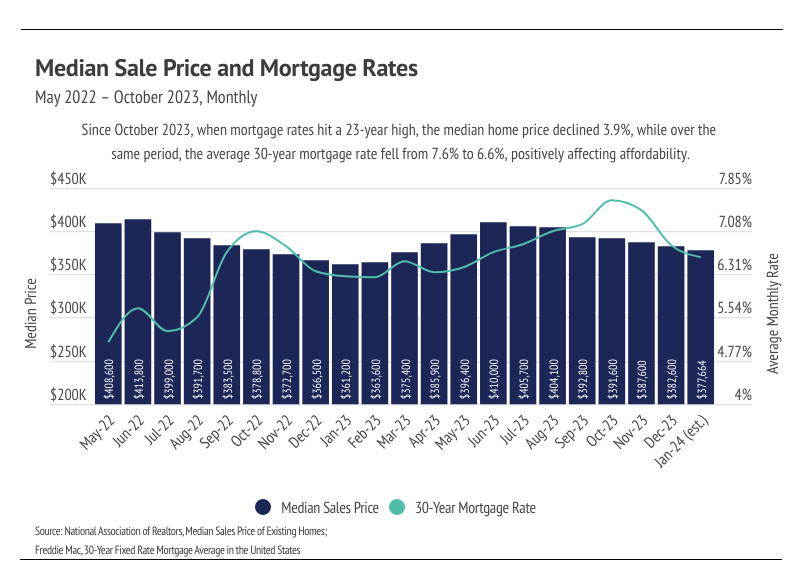

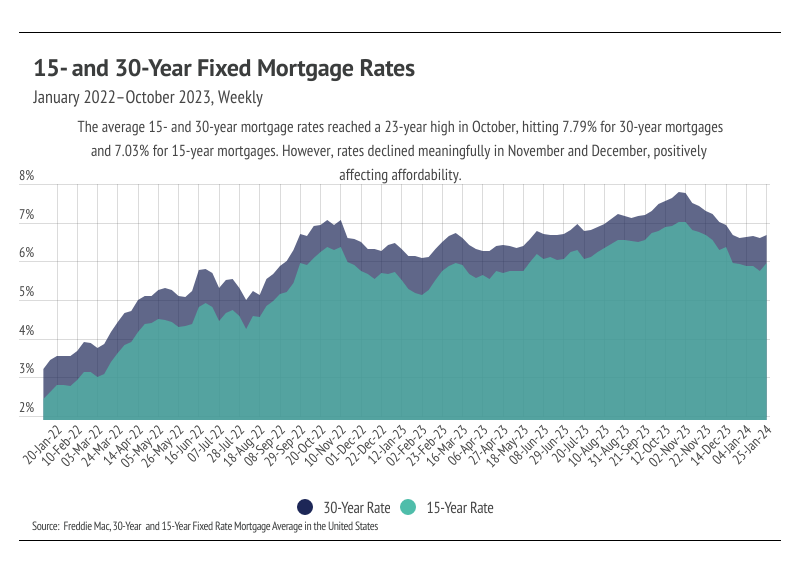

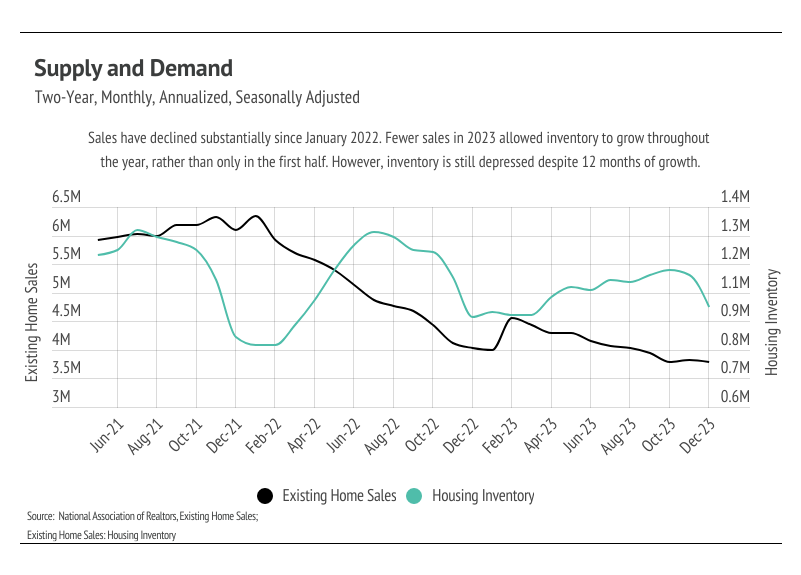

After the sharp mortgage rate drop in November and December 2023, the housing market saw real potential to warm considerably in Q1 2024, but now we expect a slower route to a healthier market. Mortgage rates remained steady at around 6.5% in January 2024, which is still about 1% higher than needed to get more participants to enter the housing market. We know the large mortgage rate drop from the 23-year high of 7.79% in October to around 6.5% wasn’t large enough to bring buyers and sellers back to the market, because the data now show that they didn’t come back. Sales reached a historic low, the number of new listings coming to market are near all-time lows, and inventory declined. This is due, in part, to normal seasonal trends — winter is when all those metrics tend to reach a seasonal bottom — but seasonality doesn’t fully explain those drops in the context of a substantial decline in rates. From October 2023 to January 2024, the monthly cost of financing a median priced home decreased nearly 13%, and the market still slowed on both the buyer and seller sides of the market, implying that rates are still too high for most would-be participants. However, we believe that if rates fall another percentage point, which roughly equates to another 10% decrease in monthly financing costs, the market will react positively and price more people into the housing market.

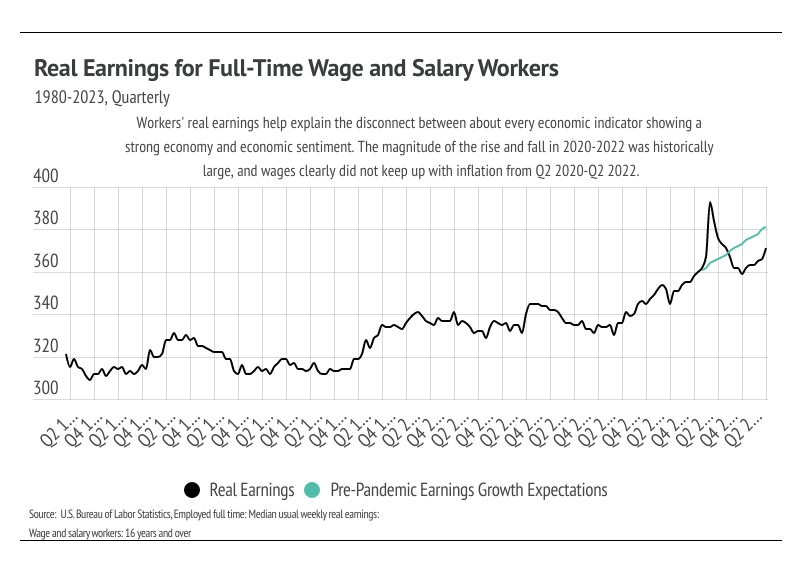

Another important aspect of the current market is the very recent positive changes in workers’ real earnings. The psychological effects of nearly 10 years of earnings growth, culminating in a final jump in the first two quarters of 2020, before dropping rapidly once COVID hit and inflation rose, was perhaps the most significant cause of the low economic sentiment in 2022 and most of 2023. People quickly become attached to the amount of money they make and the spending power of that money, so the feeling that it was taken away creates dissatisfaction. It’s also fair to say that part of the American dream is progressively increasing earnings as we age. But earnings didn’t keep up with inflation, so real earnings dropped, causing even more dissatisfaction. From 2021 to 2023, the purchasing power of the U.S. dollar declined 15%; therefore, earnings needed to increase 15% just to feel as financially well off as three years prior. For many, if not most people, earnings weren’t keeping up with inflation, and people don’t tend to buy homes when they feel less wealthy. However, after six straight quarters of real earnings growth, it makes sense that people broadly feel better about their finances, which will only benefit the housing market.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. In general, higher-priced regions (the West and Northeast) have been hit harder by mortgage rate hikes than less expensive markets (the South and Midwest) because of the absolute dollar cost of the rate hikes and limited ability to build new homes. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

The Local Lowdown

-

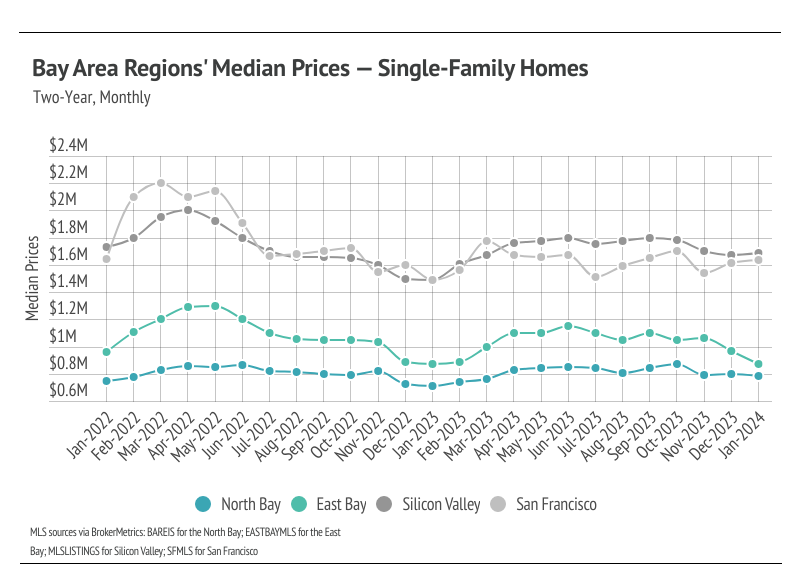

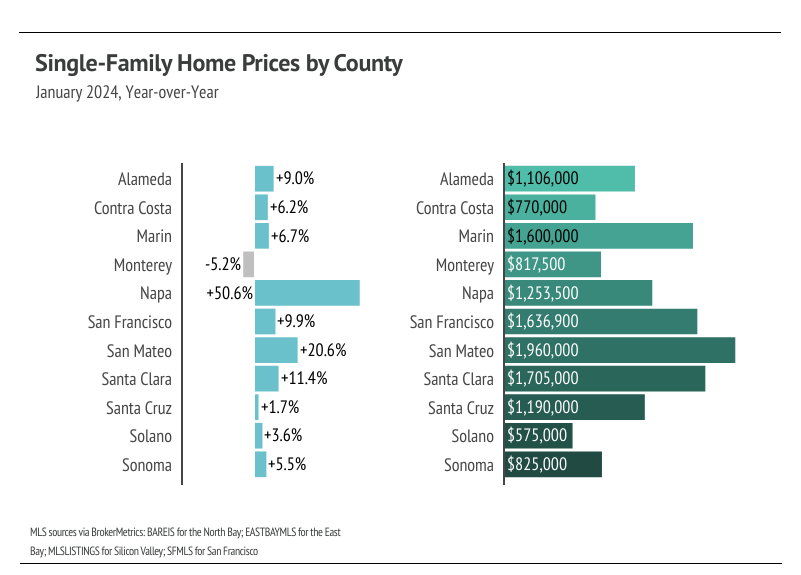

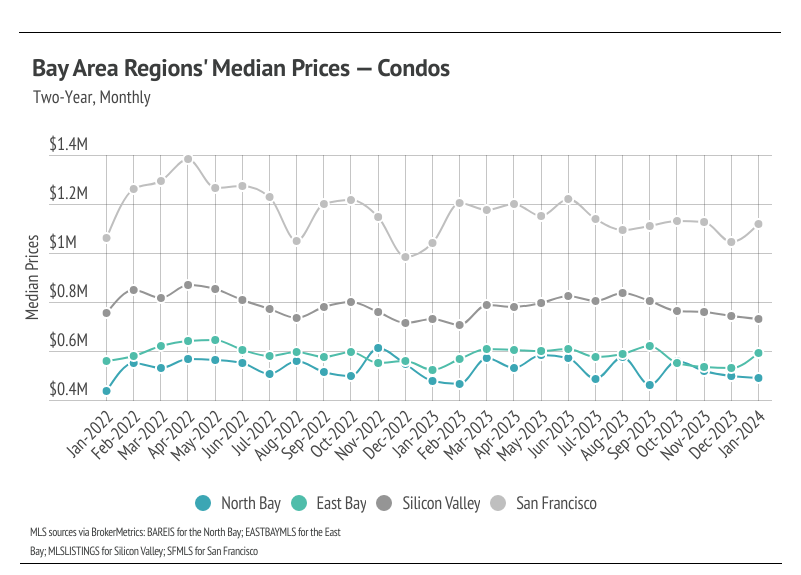

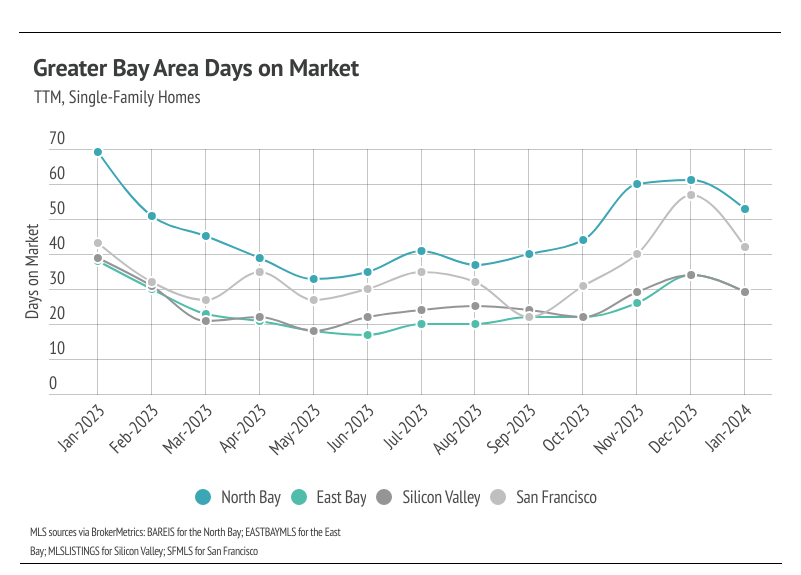

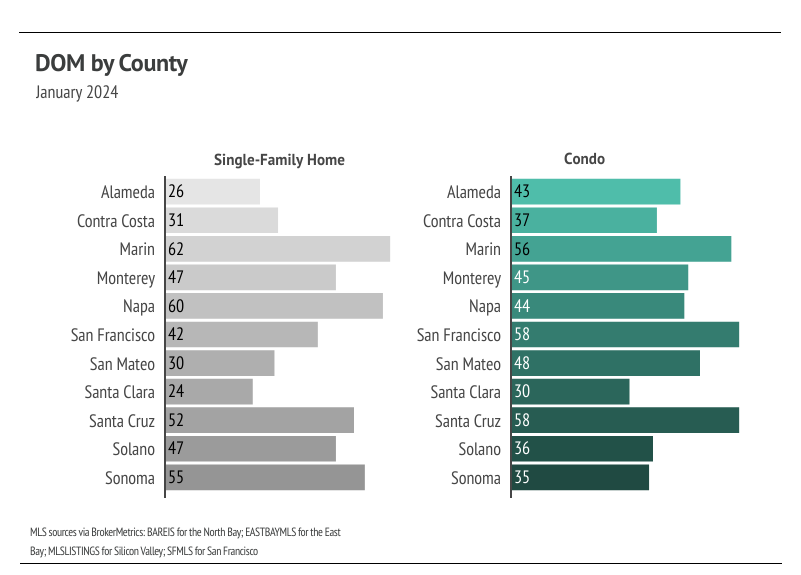

Year over year, the median single-family home and condo prices rose across most Bay Area counties in January. Low inventory and high mortgage rates have been the market’s driving factors, and we expect more buyers and sellers to come to the market in the spring as mortgage rates decline further.

-

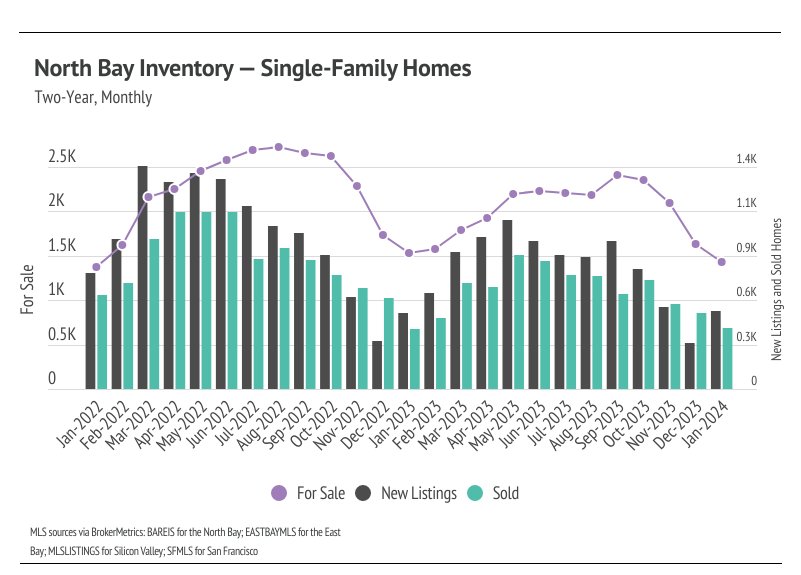

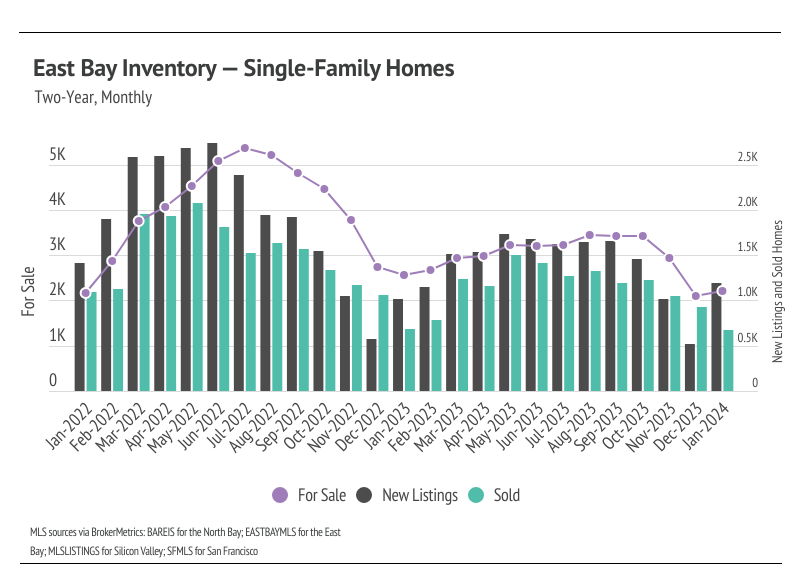

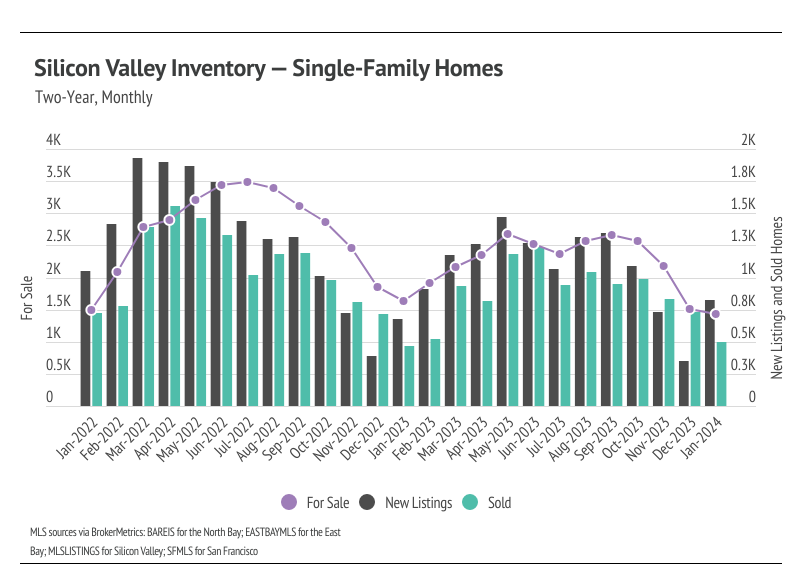

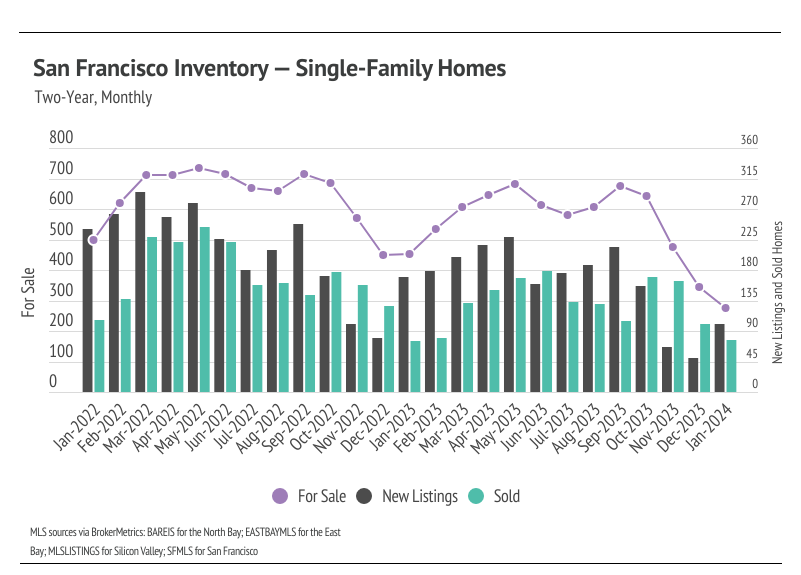

Active listings in the Greater Bay Area fell 3% month over month, even as new listings jumped 124%. As mortgage rates drop, we will likely see more new listings in the first quarter, which should help drive more sales.

-

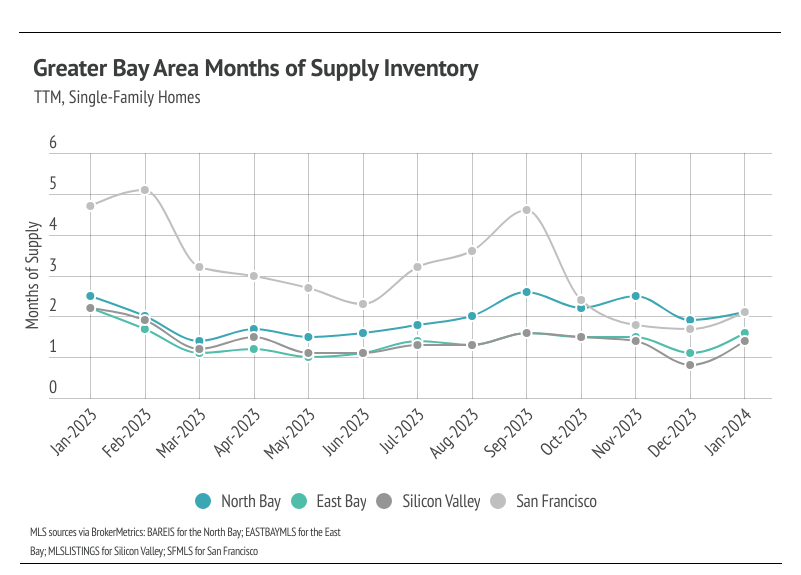

Months of Supply Inventory rose slightly from December 2023 to January 2024, as new listings outpaced sales. However, MSI still indicates a sellers’ market for single-family homes.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Year over year, median prices rose in January 2024 for single-family homes and condos

In the Greater Bay Area, low inventory has more than offset the downward price pressure from higher mortgage rates, and prices generally haven’t experienced larger price drops from higher mortgage rates since the initial period of price correction from April 2022 to January 2023. In January, the median prices across most Bay Area counties were only slightly below their record highs with the exception of Marin and San Francisco, which peaked incredibly high in 2022. We expect prices to remain fairly stable in the winter months, but as interest rates decline and more sellers come to the market, prices will almost certainly rise in the first half of 2024. However, more homes must come to the market in the spring and summer to get anything close to a healthy market.

High mortgage rates soften both supply and demand, so ideally, as rates fall, far more sellers will come to the market. Rising demand can only do so much for the market if there isn’t supply to meet it. Unlike 2023 inventory, 2024 inventory has a much better chance of following more typical seasonal patterns.

New listings rose 124% month over month

Single-family home and condo inventory barely increased at all last year, which is far from the seasonal norm. In 2023, inventory didn’t have anything resembling the typical sine wave, since far fewer sellers came to the market, especially in the first half of the year, and the low inventory and fewer new listings slowed the market considerably. New listings were exceptionally low, so the little inventory growth last year was driven by softening demand. Typically, inventory peaks in July or August and declines through December or January. In December, inventory, sales, and new listings dropped across Bay Area markets. However, in January, new listings rose 124% month over month, and homes coming under contract increased 22%. Year over year, inventory is down 9%, but sales and new listings are up 4% and 12%, respectively.

Months of Supply Inventory in January 2024 indicated a sellers’ market

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The Bay Area markets tend to favor sellers, which is reflected in their low MSIs. San Francisco MSI is notable for its variability over the past year, oscillating from buyers’ to sellers’ markets twice over the course of 10 months. Currently, single-family home MSI is below three months of supply (a sellers’ market) in every Bay Area county except for single-family homes in Napa, which now favors buyers. The condo markets are a little more mixed, but mostly balanced.

We can also use percent of list price received as another indicator for supply and demand. Typically, in a calendar year, sellers receive the lowest percentage of list price during the winter months, when demand is lowest. January tends to have the lowest average sale price (SP) to list price (LP), and the summer months tend to have the highest SP/LP. The January 2024 SP/LP was higher than last year across most of the Bay Area, meaning we expect sellers overall to receive a higher percentage of the list price in 2024 than they did in 2023.