Napa Housing Market Update - September 2024

The Big Story

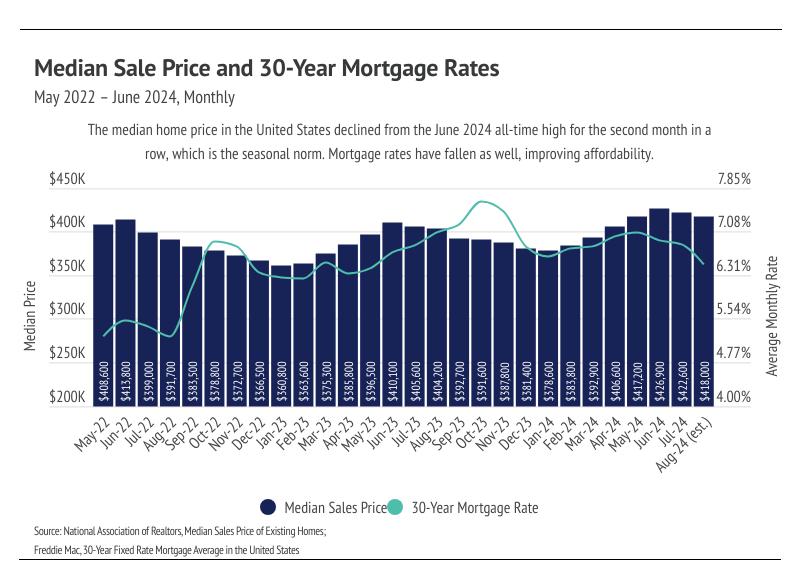

Lower Prices and Lower Mortgage Rates

Quick Take:

-

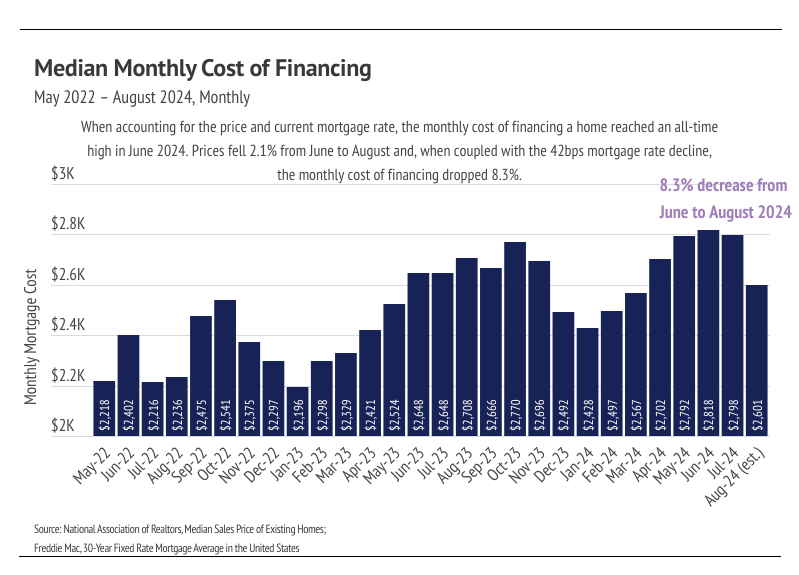

Nationally, the monthly cost of financing a median-priced home was 8.3% lower in August 2024 than in June because the median home price declined 2.1% over the past two months, and mortgage rates have dropped.

-

In August, the average 30-year mortgage rate declined for the third month to 6.35%, a 0.87% drop from the 2024 high reached in early May. The Fed is expected to cut rates by at least 0.25% in its September 17-18 meeting. Rate cuts will benefit the current market.

-

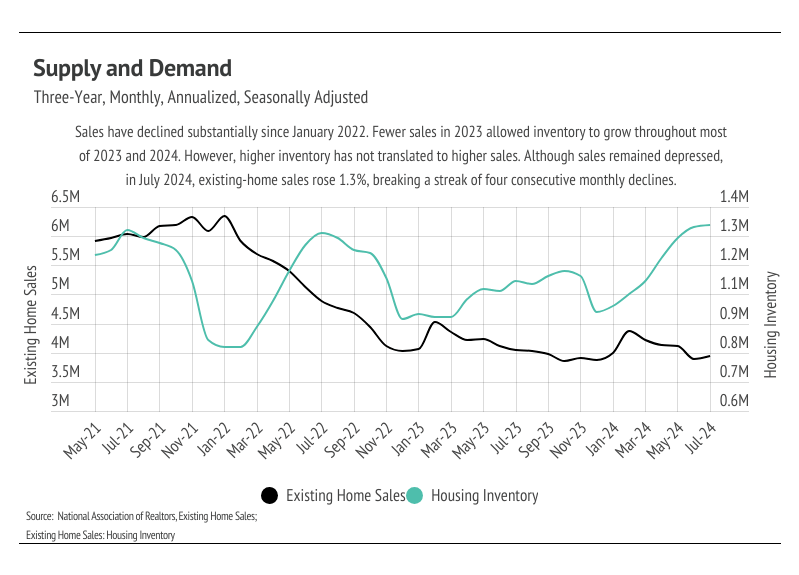

Sales rose 1.3% month over month, ending a streak of four consecutive monthly declines, while inventory rose to its highest level since 2020. Because sales have been so sluggish this year, we may see sales increase in the fall, as rates fall and homes become more affordable.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

Affordability matters. Go figure!

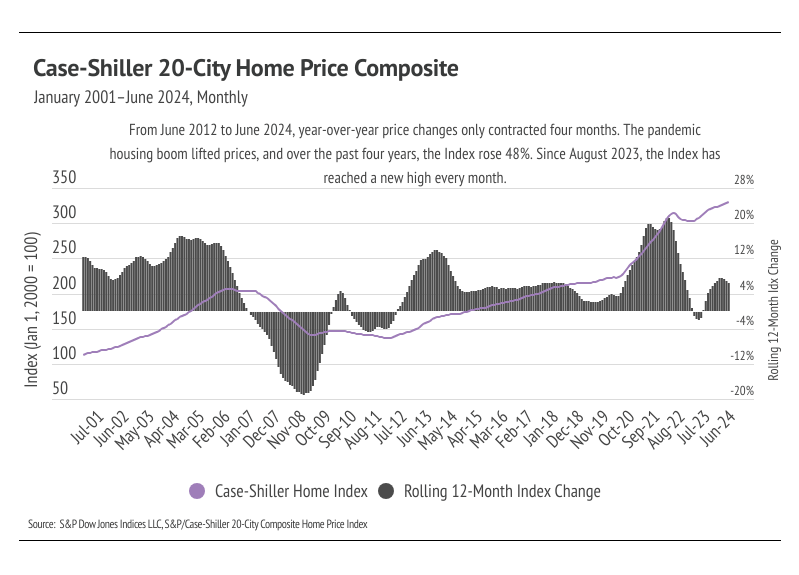

Despite low affordability through June 2024, affordability began improving in August 2024. The median U.S. home price reached a record high in June 2024, as did the monthly cost of financing a median-priced home, even though mortgage rates weren’t quite at their highest level this year. In other words, affordability hit a record low in June. Generally, prices tend to peak in June during any given year, even though the market veered away from this seasonality for a few years during the pandemic. It was no surprise, therefore, when prices declined slightly in July and August of this year. Additionally, during July and August, inflation lowered meaningfully, which means rate cuts. The anticipation of rate cuts alone led to lower rates in July and August. Over the past two months, the average 30-year mortgage rate fell 0.51%, which drastically improved affordability.

A rough but decent shorthand calculation for mortgage rates is that every 0.10% increase or decrease to mortgage rates equates to roughly a 1% increase or decrease in the monthly mortgage cost. This means that, over the past two months, the monthly payments on homes became approximately 5% cheaper.

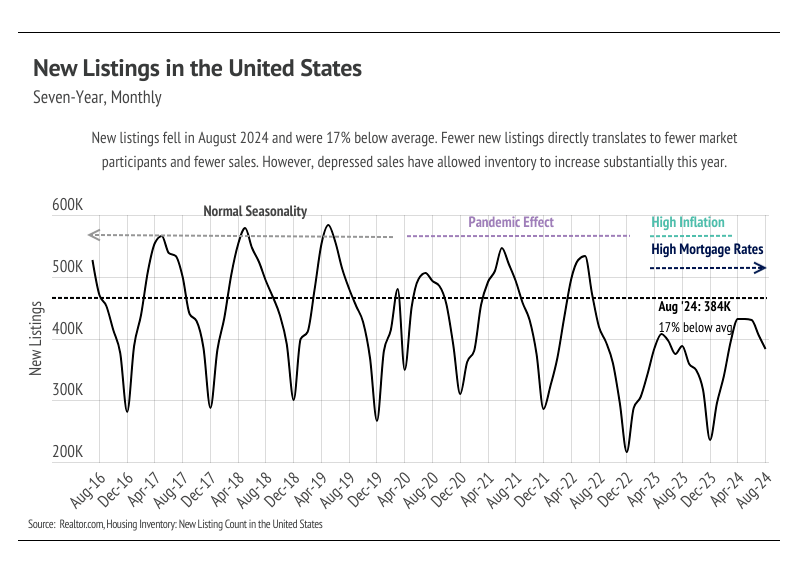

Sales and inventory generally also decline in the second half of the year. However, this historical trend has broken over the past couple of years. Sales have been historically low since January 2023; so, even though new listings have also been depressed, inventory has grown to its highest level since 2020. At this moment, homebuyers have more choice than they’ve had in years. Higher supply, lower price, and lower interest rates caused sales to increase month over month, albeit only slightly — up 1.3%.

Sales may continue to increase, however, because of the improving conditions, and sales levels are so low they almost have nowhere to go but up. The mid-September Fed meeting will likely bring about the first in a series of rate cuts, and the housing market may fare extremely well next year due to the timing of the cuts. The inventory build-up will likely slow for the rest of the year; but, since it’s already grown substantially, that isn’t concerning. We expect to enter 2025 with falling rates, high inventory, and seasonally lower home prices, which should create a perfect storm for a hotter spring market. We realize spring is a bit far; but, until then, we expect the sluggish market we’ve experienced over the past two years to persist, at least in terms of sales. The current market is favoring buyers, so if you’re thinking of buying, we can at least say that you have the most options to choose from.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

-

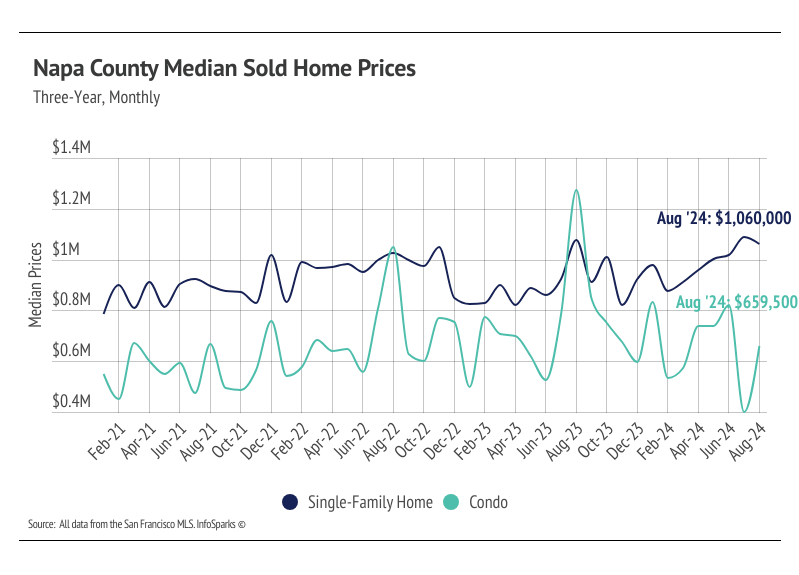

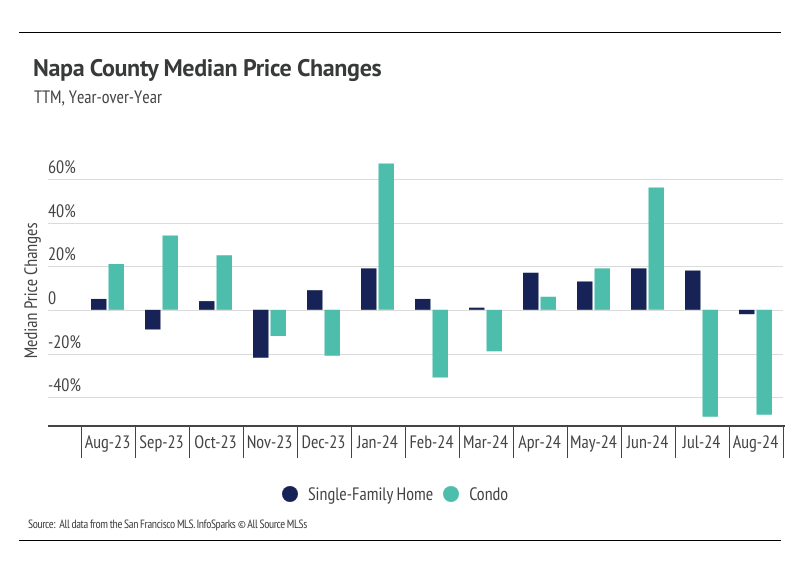

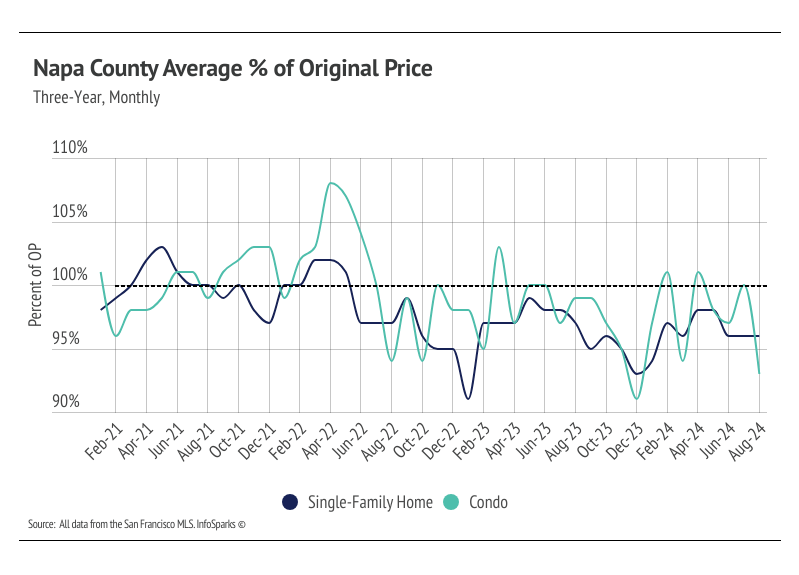

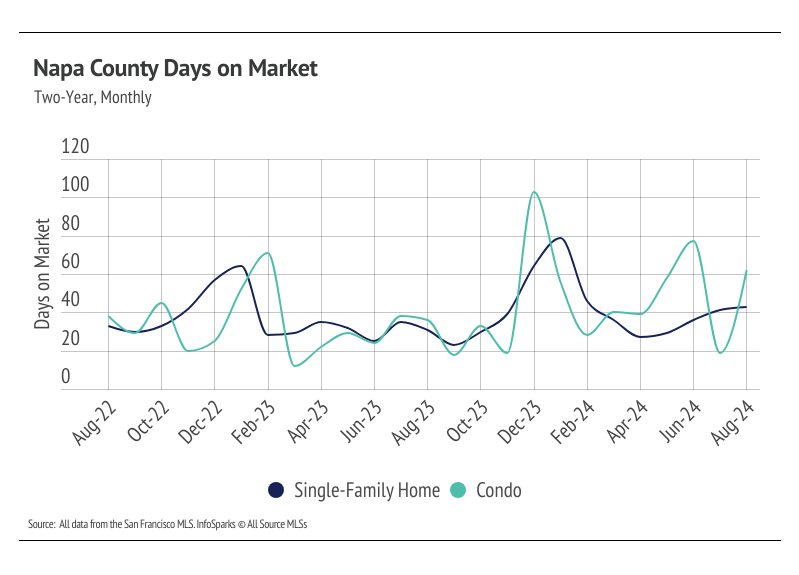

The median single-family home price fell 2.5% month over month, while condo prices rose 64.9%. Because the condo market is so small in Napa, it is prone to larger median price swings. We expect price contraction for the rest of the year, which is the seasonal norm.

-

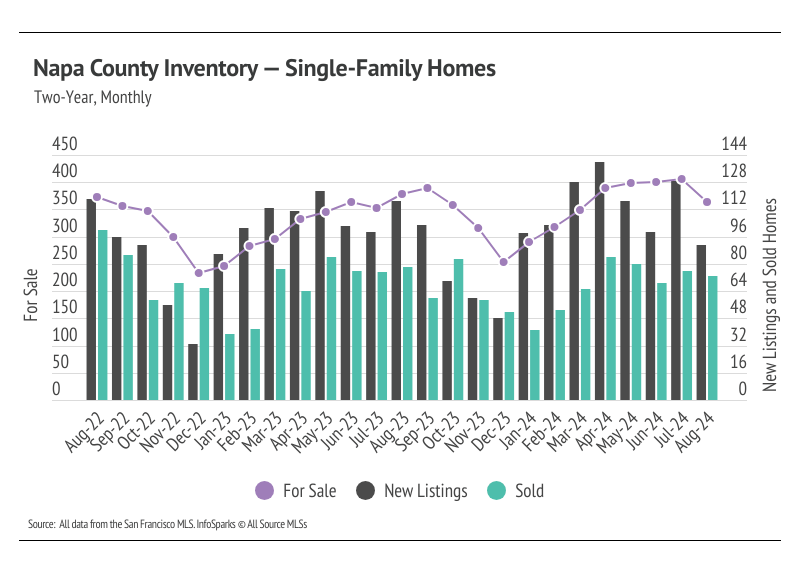

Total inventory fell 8.4% month over month, as sales and homes under contract far outpaced new listings. We expect inventory to decline and the overall market to slow as we make our way through the second half of the year.

-

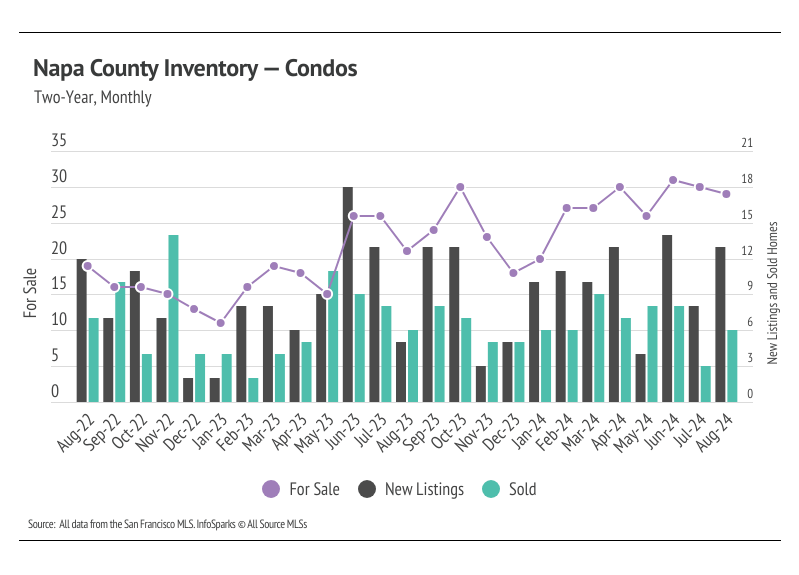

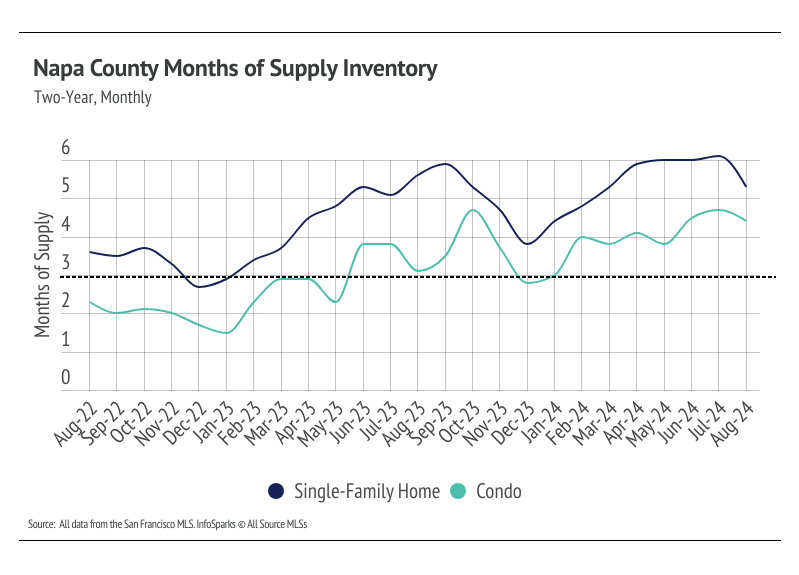

Months of Supply Inventory declined month over month, indicating the market is improving for sellers. Currently, MSI indicates a buyers’ market for both single-family homes and condos.

Categories

Recent Posts